PPC 2021 in review: Privacy and automation force advertisers to adapt

From the deprecation of broad match modified keywords to FLoC to RSAs becoming the default, PPC professionals dealt with a lot of change in 2021.

Prompted by the vision that platforms, like Google, have for their services as well as increased concern over user privacy, these changes underscored adaptability as one of the traits that define successful marketers. Below, we’ve summarized the most impactful changes, announcements and developments that shaped PPC this past year and, in all likelihood, will continue to influence the years ahead as well.

Farewell, broad match modified keywords

In Q1 2021, Google announced a significant change to how it treats phrase match keywords by expanding it to include broad match modifier traffic (BMM).

“Broad match now looks at additional signals in your account to deliver more relevant searches,” Google also announced. These signals include landing pages and keywords in your ad group.

The PPC community’s reaction to this news was mixed: “With the recent changes that Google has made, it seems like a bit of a (very) thinly veiled attempt to take back control from advertisers,” said Amy Bishop, owner of Cultivative, “You can’t optimize against what you can’t see, and you certainly can’t optimize against controls that have been taken away.”

Kirk Williams, owner of ZATO Marketing, had a different opinion: “This is simply a logical progression in [Google’s] ever-changing match type behavior that mirrors changes in other areas, pointing towards a world in which Google uses the millions of signals under its control to make auction time decisions for which the limited, human advertiser is unable to make as technology and machine learning bidding solutions progress.”

In Q2 2021, the final nail in BMM’s coffin was hammered in when the platform announced a deprecation date for BMM keywords. To put an end to the saga (for now), Google also made it so that phrase match or broad match keywords that are identical to a query are now always preferred as long as they are eligible to match.

And, a few months after Google’s initial announcement, Microsoft Advertising said it would also expand phrase match to include BMM traffic.

Bundled bid strategies replaced standalone options

Google updated its Smart Bidding in April 2021, bundling the Target CPA (tCPA) and Target ROAS (tROAS) strategies with the Maximize Conversions and Maximize Conversion Value bid strategies.

Three months later, the company removed standalone Maximize conversions and Maximize conversion value bid strategies for search campaigns. Shortly after that, Google removed the old tCPA and tROAS options from standard campaigns, effectively completing the bundling of these bid strategies.

Microsoft Advertising made an important change in this area as well: Beginning in March 2021, it migrated all search, shopping and Dynamic Search Ads campaigns without an automated bidding strategy in place over to Enhanced CPC.

FLoC was heavily debated, but not rolled out

With the deprecation of third-party cookies slated for 2022 (which Google later pushed back to the latter half of 2023), it wasn’t much of a surprise when Google first announced that it was testing an alternative targeting technology in October 2020. Known as Federated Learning of Cohorts (FLoC), the proposal was opened for advertiser testing in Q2 2021.

Related: FLoC is coming — Here’s what we know so far

Despite being billed as more privacy-friendly for users, there were widespread concerns about techniques such as fingerprinting, which could be used to reverse engineer individuals from the cohort. The Electronic Frontier Foundation even published an article opposing the proposal. Marketers also shared concerns that Google was being opportunistic and using the deprecation of third-party cookies to create a “walled garden” for itself.

Chrome’s competitors have no plans to adopt FLoC, which will limit its functionality. There was even a proposal by WordPress to block FLoC by default. The UK’s Competition and Markets Authority also engaged Google about the proposal and the search company agreed not to favor its own products or access personal user data.

To keep the industry updated about its progress with FLoC, Google published a Privacy Sandbox timeline. As of December 2021, FLoC is scheduled to undergo testing from Q1 to Q3 2022, with adoption slated for Q4 of that year.

Google Ads gave PPC professionals a lot to adapt to

In addition to the updates mentioned above (and below), Google Ads made a number of other impactful announcements in 2021.

One of the most noteworthy changes was that responsive search ads (RSAs) became the default ad type for Search campaigns. Google later followed that news with a sunset date for expanded text ads (ETAs), which will become unavailable beginning in July 2022. As it did with the phrase match change, Microsoft Advertising also announced that it would be deprecating ETAs starting on June 30, 2022.

This was also the year that Performance Max campaigns, an automated campaign type that runs across all Google ad inventory, became available to all advertisers. Google bundled that news (as it seems to have done quite frequently in 2021) with another announcement: Smart Shopping and Local campaigns would be “upgraded” to Performance Max in 2022.

Performance Max campaigns are also part of the Google Ads Insights Page, which shows currently trending searches, auction insights and interest predictions tailored to the account. In November 2021, the company expanded on the Insights page by adding four features: consumer interest insights, audience insights, change history insights and auction insights, and demand forecasts.

In April 2021, instant match rates became available for Customer Match, which allows advertisers to use their first-party data to remarket to customers on Google Search, Shopping, Gmail and YouTube. Then, in November 2021, the platform rolled out some of Customer Match’s features to all policy-compliant advertisers, enabling them to observe their lists to see how well they perform against the general audience, among other capabilities.

Advertisers gained access to some new data when Google announced that it would show historical data for queries that received impressions but no clicks in the search terms report for Search and Dynamic Search Ads campaigns. This didn’t reverse the September 2020 change that initially limited search terms reporting, as the data is still only for “terms that were searched by a significant number of users,” but the data could reveal what’s failing to attract the right audience. If you haven’t exported your historical query data, make sure to do so before February 1, 2022 — that’s when Google plans to remove historical query data collected prior to September 1, 2020, from the search terms report.

In terms of other fresh capabilities and updates, Google Ads ditched campaign drafts in an updated experiments page, which eliminated a clunky part of the workflow for testing. There was also a new budget report, which shows a monthly spend forecast that advertisers can use to understand how editing their budget can affect the campaign’s spending limit.

The Google Partner Program changes that were initially slated to go into effect in June 2020 were pushed back to February 2022 due to the ongoing effects of the pandemic. In addition to the postponement, Google revisited some of the changes, namely enabling Partners to either dismiss or apply recommendations to achieve a 70% optimization score and keeping the 90-day spend threshold at $10,000 (instead of the proposed $20,000 every 90 days). After the delay announcement, Partners that already met the 2022 requirements before the deadline requested to receive their new badges — Google consented.

The company also began testing a new three-strikes program for accounts that repeatedly violate ad policies. The system starts with a warning and no penalties for an initial violation. From there, each violation has an increasingly stringent penalty until the account is finally suspended. PPC professionals were largely in agreement with the program, though they were very skeptical about policy application due to the frequency of incorrectly flagged ads.

Microsoft Advertising made waves of its own

One prominent pattern we observed this year was Microsoft’s investment in industry-specific ad products: it released features specifically for automotive, tour and leisure, credit card and health insurance businesses.

The company also integrated Microsoft Clarity, its free tool to help site owners better understand visitor behavior, with Microsoft Advertising, which may help marketers analyze post-click behavior to identify roadblocks on the path to conversion.

Advertisers in the U.S. might also be happy to know that Microsoft rolled out support for Spanish language ads this year as well.

Vertical-specific ad updates

Shopping. Since Google and Bing launched organic Shopping results, many of their commerce-related product offerings have been designed to serve both advertisers and non-advertisers. One running theme in 2021 was the proliferation of shopping integrations, which are typically plugin-type solutions that enable retailers to get their product listings into organic results or run paid ads directly from their CMS, making it easier for SMBs that don’t work with an agency.

Google rolled out Shopping integrations for Shopify, PrestaShop, BigCommerce, WooCommerce, GoDaddy and Square. Microsoft Bing also launched an integration for retailers on Shopify.

Related: How to identify your products for Google

Local. At its annual Marketing Livestream event, Google announced a number of new local campaign ad formats, including:

- Auto Suggest ads, which show ads based on the searcher’s location. The example Google gave for this was that if you search for “oil change” in Maps, Google might show an ad for an auto garage that is near your current location.

- Navigational ads, which are shown when a person is en route to a destination using Maps driving directions.

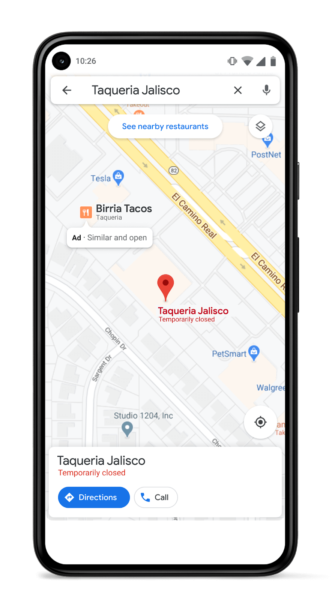

- Similar Places ads (shown below), which can show when a user searches for a specific business that is closed at the time of the search.

In addition, the company also launched an open beta for US-based advertisers to expand store pickup options by adding a “pickup later” label to their local inventory ads.

Yelp also broke new ground by launching Yelp Audiences, its first offering that enables both location-based and non-location-based advertisers to reach Yelp users across the web, based on their Yelp search activity.

Video and image. YouTube ad creation became simpler for SMBs this year — in June, the company announced a new workflow, enabling advertisers to launch a campaign by adding a video, selecting the audiences they want to reach and designating a budget.

Google also added the ability for brands to show browsable product images below their video ads for campaigns that have “Product and brand consideration” or “Brand awareness and reach” set as the goal. Prior to this update, Video action campaigns were the only campaign type that could be linked to product feeds from Google Merchant Center.

In Q3 2021, YouTube ads were the breakout star of Google’s earnings report, bringing in $7.2 billion in revenue, an increase of 43% quarter-over-quarter. With that kind of success, the company may decide to release more video-oriented features and products for advertisers in 2022.

In other video advertising news, Google transitioned to parallel tracking for Video ads on April 30. The company also announced that TrueView for action campaigns is set to be transitioned into Video action campaigns beginning in early 2022.

And, Microsoft Advertising rolled out Video Extensions, which can be used to highlight a video right in the search results. Google rolled out image extensions for desktop devices as well.

Safety for advertisers and users

With privacy constantly making headlines over the last year, Instagram disabled interest and activity-based targeting of underage users in August 2021. At about the same, Google made a similar move, blocking targeting based on age, gender or interests of users under 18 years old.

Brand safety continued to be a concern for advertisers and platforms responded by introducing exclusion controls: Facebook expanded its test of topic exclusion controls, claiming that advertisers were able to avoid appearing next to excluded categories 94-99% of the time. And, Google began rolling out dynamic exclusion lists around April 2021.

Advertising and law

Google was at the center of a number of accusations and regulatory predicaments this year, which is typical in just about any given year. However, this year started out with an event unlike any other — the January 6 attack on the U.S. Capitol. A week after the attack, Google paused all political ads through to the inauguration. Interestingly, five months later, researchers from the University of Michigan School of Information published a study that found that Google serves 48% of all ad traffic on “fake” news sites.

Related: Halting campaigns shouldn’t be your only brand safety precaution

For ads served in India and Italy, Google passed on digital service taxes (levied on it by regulatory entities) to advertisers. It was already doing this to advertisers for ads served in Austria, Turkey, the UK, France and Spain. In March, Maryland became the first state to impose a tax on digital advertising — legislatures in other states, like New York, Connecticut, Washington, West Virginia, Montana, Nebraska and the District of Columbia are also considering imposing their own taxes on digitals ads or the sale of data. It’s not clear how this will pan out domestically, but advertisers should look to their European counterparts to learn how to deal with it (if the time comes).

In June, Google agreed to adjust its ad technology to provide more flexibility and transparency as well as improve the way its Ad Manager services works with rival ad servers and sales platforms, in addition to paying a $268 million fine to French regulators — the French Competition Authority claimed that Google Ad Manager provided AdX (where publishers sell space to advertisers in real-time) with exclusive data to improve its own chances.

And, details from “Jedi Blue,” an alleged arrangement between Facebook and Google in which the latter would charge the former lower fees and give Facebook other advantages in header bidding auctions in exchange for the social media platform’s support on Google’s header bidding alternative, were made public throughout the year.

The collusion aspect may carry heavy consequences for both entities, but it will be a long time before there’s a conclusion to this story. When asked about Jedi Blue, the marketers that spoke to us seemed indifferent, citing the lack of viable Google alternatives for advertising.

Looking ahead to 2022

We’re certain to hear more about FLoC and the deprecation of third-party cookies as we make our way through 2022 — timelines may shift as they have in years passed. While third-party cookies aren’t going away until 2023, ETAs will be sunsetted in July 2022, so advertisers should test out RSAs before they have no choice but to use them.

On February 1, 2022, Google will remove historical query data collected prior to September 1, 2020, so advertisers should export that data to reference later before that deadline. Smart Shopping and Local campaigns are also changing sometime in 2022 — they’ll be rolled into Performance Max campaigns.

And, agencies participating in the Google Partner Program should also mark their calendars for February 2022, when the program’s requirements are set to change.